Difference Between Investment And Gambling In Tabular Form

- Most gambling is not done with discretionary income. Money that should go for food, rent, clothing is often risked in a “get-rich-quick” scheme. So while I would acknowledge that investing and gambling have some similarities, the differences make the difference.

- This is the most essential difference between gambling and investment. The investors and traders have different options to preserve themselves from a complete loss of their capital. To put a stop order to your shares is a simple method of avoiding the risk.

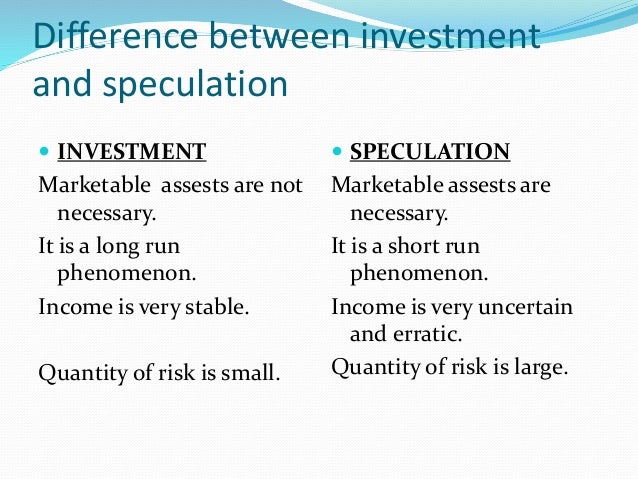

- 'The difference between investing and gambling or speculating is taking calculated versus uncalculated risks,' says Greg Woodard, managing director of portfolio strategies at Manning & Napier, an.

- Investment advisors, wealth management, finance, education, investing, Equities, India, building wealth, intelligent investing.

- Difference Between Investment And Gambling In Tabular Form Example

- Difference Between Investment And Gambling In Tabular Form Pdf

Probably you have heard more than once that stock investment is like gambling in casino. Is this really true? Let’s take a closer view of these two activities and find their similarities and differences.

Difference Between Investment And Gambling In Tabular Form Example

Investment and gambling include risk and choice, comment from investopedia. The gambler, as well as the investor should decide to what extent they would take a risk. Some traders usually risk 2-5 % of their capital in a particular transaction. The long-term investors often make diversification among different asset classes. This is actually a strategy for controlling the risk and the apportionment of your money in different investments reduces the possibility of potential loss.

Another key difference between the two activities has to do with the concept of time. Gambling is a time-bound event, while an investment in a company can last several years.

Gamblers also should assess carefully the sum of their capital they want to put on the table. The chances in gambling are also a way of estimating the risk of a possible loss. The sum that should be played is the stake for everything that stands on the table. If the chances are opportune, the player is likely to pay the stake. Most of the professional gamblers are pretty skillful in controlling the risk. Both in the gambling and investment, there is a basic principle to minimize the risk, while you maximize the earnings.

Sport gambling is probably the most widespread game of chance where an average person could take part.

If you think about your gambling habits, you will realize that you do not have a method to restrict the loss. If you give 10 dollars every week to gamble on football matches and you do not win, then you lose all of your capital. If you stake in this way on sports, there are no strategies to restrain your loss.

This is the most essential difference between gambling and investment. The investors and traders have different options to preserve themselves from a complete loss of their capital. To put a stop order to your shares is a simple method of avoiding the risk. If your share comes down with 10% to purchasing price, you are able to sell it, remaining with 90 % of your capital. However, if you gamble 100 dollars that Manchester will become European champions this year, you won’t take your money back if they lose the finals.

Another main difference between the two is associated with time. Gambling is a limited event, while the investments in a company may continue for a couple of years. When you gamble and your hand is over, the possibility for earning is gone. You win or you lose. In the same time, stock investments could be useful in a time perspective. Investors who buy shares in some firms that pay dividends, compensate their loss. Companies pay money no matter what happens with the invested capital. The clever investors realize that the profitability by dividends is an essential component in making money for a long term.

Investors, as well as gamblers seek for an advantage to improve their advantage. The good gamblers and investors examine people’s behavior in one way or another. The poker players usually watch for signs from the other players on the table, and the great players follow their opponents’ stake 20 hands back. They also examine the manners and stakes of their competitors. The gathered information may help them to forecast their moves.

In a similar way, traders examine the price charts. Some of them use technical analysis and try to follow the future movement of the price according to these charts.

One more difference between gambling and investment is the information access. Information is valuable in the world of poker as well as in the world of investments. The information for a company is given to the public. The financial results, ratio, management teams could be examined before putting money in the stock. Of course, the stock information is much more valuable, otherwise, there would not be trading with the inside information and Securities Commission.

If you sit on a Blackjack table in Las Vegas, you do not have the information what have happened before two hours or a couple of days in this particular table. You may hear that the table is hot or cold, but this information is not trustful.

Difference Between Investment And Gambling In Tabular Form Pdf

To put it shortly, both activities include risk for the capital with the hope of future earnings. Usually gambling is fugitive activity, while investments may continue during your whole life. However an average investor would manage much better his life, than a world poker player.